| Current | v9 | v8 | v7 | v6 | v5 | v4 | v3 | v2 | v1 | All | About |

Numbers

Initially each collector2 averaged about 200 leads per sale which drove just enough profits to keep the company afloat. A lead was first bought at a flat rate of 10 US dollars which at an average of 200 per sale the profit for the collector was a comfortable 2,000 US dollars. On the flip side of things, Corp. A was successfully conducting business averaging about 10 sales for every 100 leads they bought. With these numbers consistently coming through Corp. A made a profit of about 10,000 US dollars for every successful sale. A little math illustrates the return on investment ratio:

Based on the collection of an insignificant amount of information, collectors aggressively innovated their collections methods. I will elaborate on what I mean shortly. For now, I will focus on what happened immediately after.

New collection methods drove the lead delivery out of control and soon Corp. A was inundated with so many leads that they had to start turning them down until they figured out how to process the volume. In order to handle the number of leads they were now attaining, they decided to partner with smaller companies and sell them the overflow. Corp. A was now growing exponentially fast, and in a period of roughly five to six years, this simple idea drove Corp. A from bankruptcy to a multi-billion dollar corporation.3

People and greed do not mix very well, and as I mentioned, earlier collectors and partners wanted more money, so soon other companies began buying leads from collectors too. I argue that at the time the mortgage industry was large enough for everyone to profit nicely from it, however greedy collectors began selling bogus or non-exclusive leads. This forced mortgage firms to develop a loose classification model for grading the quality of a lead as an addition to the classification of the leads themselves.

Exclusive

An exclusive lead is one that is sold only to one mortgage firm and never again redistributed. The value of these leads was often higher than non-exclusive, or as they decided to term them, semi-exclusive leads.

Semi-Exclusive

Yes, semi-exclusive. I honestly cannot define this, as this is an oxymoron itself, but someone somewhere4decided to call non-exclusive leads semi-exclusive to allow them to be resold. It's a nice euphemism, though.

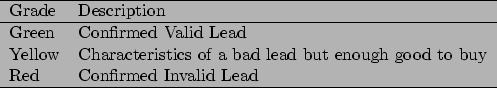

The reliability of a bulk set is assessed by the person buying them at the time of sale. The person interested in buying the leads takes a random set from the bulk he is receiving and personally verifies their validity. A rating is then given depending on the number of missed leads he finds. The grading is different with every person you deal with, but in short a lead is only Green if validated.5. A yellow lead is a lead with all information accurate but the candidate was either not home or for some reason was not available. Last, a red lead is a confirmed invalid or bogus lead. A number of things can give away a bad lead, for example Zip code and State not matching, or the name given is John Doe and the address contains Elm Street are probably indications of a bad lead.